Take the Uncertainty Out of Calculating IRS Interest and Penalties

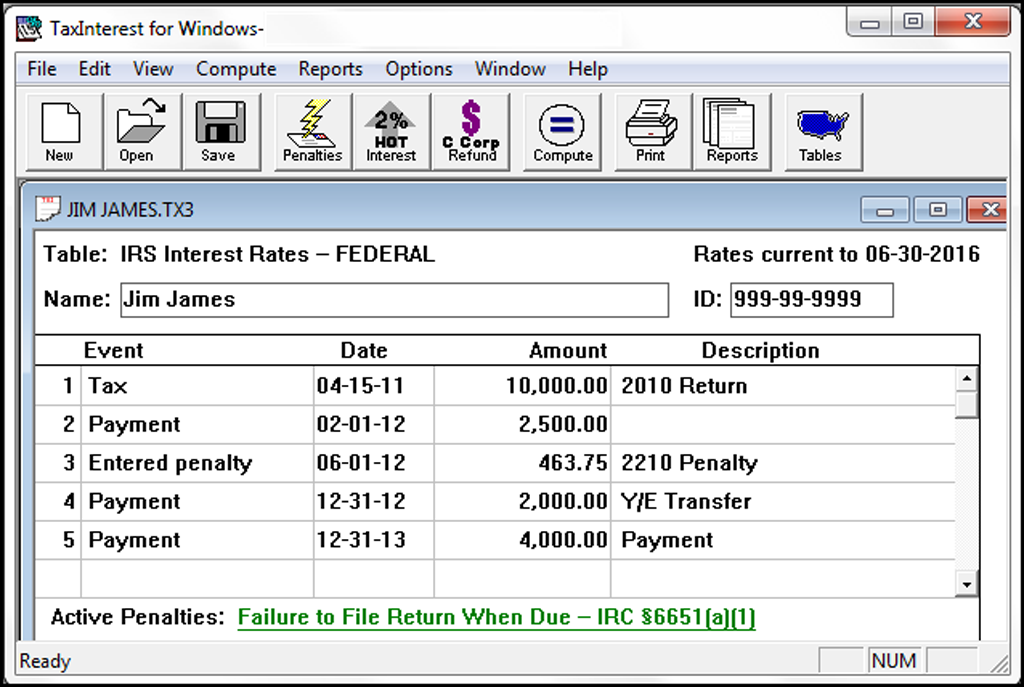

Accurate interest and penalty calculations shouldn’t be difficult. Checking an IRS transcript. Preparing an amended return or a return for a late or non-filer. Determining penalty amounts. TaxInterest software is the professional standard that helps you calculate the correct amounts – easily, reliably, and with no guesswork.

- VERIFY IRS INTEREST

- VERIFY IRS PENALTIES

- STATE INTEREST CALCULATIONS

- DETAILED REPORTS

- SYSTEM REQUIREMENTS

TAXINTEREST SETS THE BAR HIGH FOR ACCURACY

- Simplify calculation of both individual and corporate interest

- Calculate Federal (Section 6621) underpayment interest from 1954

- Determine large corporate “Hot” interest

- Calculate GATT overpayment interest refund automatically

- Produce interest and penalty accruals for FIN 48 (ASC 740-10) uncertain tax positions (UTPs)

- Automatically calculate interest on penalties and specify notice dates

- Compute estimated tax penalties 2210 and 2220

COMPUTE THE POTENTIAL EXPOSURE FOR PAST DUE TAXES

- Verify figures from IRS or state transcripts with confidence

- Quickly calculate common federal penalties including Failure to File 6651(a)(1), Failure to Pay Tax Shown 6651(a)(2), and Failure to Pay Amount Assessed 6651(a)(3)

- Accuracy Related penalties include Negligence 6662(c), Substantial Understatement 6662(d), Fraud (6663), and more

- Create detailed reports to document your work

CALCULATE UNDERPAYMENT AND OVERPAYMENT INTEREST FOR ALL STATES WITH INCOME TAXES

- Individual and corporate calculations

- Computation methodologies for each state

- Calculate Canadian federal, provincial, and territorial interest

- Customize rates as needed for sales tax, estate tax, lookback, excise, and more

- Produce interest accruals for FIN 48 uncertain tax positions (UTPs)

- Catch and eliminate costly mistakes

TAXINTEREST REPORTS ARE WIDELY RECOGNIZED BY TAXING AUTHORITIES

- A great tool if there is a discrepancy with the IRS or state agency

- Reports display rates, calculation methods, monthly interest accruals, factors, and more

- Professional and easy to read

TaxInterest System Requirements

- Computer: 2 GHz or higher

- Operating System: Windows 10 or higher and Windows Server 2016 or higher.

(Citrix is being used successfully with no known issues in this environment) - Memory: At least 40MB RAM

- Hard Disk Space: At least 20MB free disk space

TaxInterest Takes the Unknown Out of Calculating IRS Interest and Penalties

Watch a Short Video on the Capabilities of

TaxInterest Software

Pricing

Frequently asked questions

Can I use TaxInterest for other past due tax amounts other than income taxes?

The IRS has one interest rate and some deviations from that. Most states have one interest rate for all their taxes. So the answer is probably yes. There are a few states that have different rates for different taxes. You can build custom tables in TaxInterest too.