Present Value (PV) or Net Present Value (NPV) are fundamental concepts in finance that help us determine the current worth of a future sum of money. There are many areas of finance that use PV calculation. It essentially discounts the future value to today's dollars, considering the time value of money and the expected rate of return, and produces an amount of the value of the cash flows today, the present.

When do I calculate a present value?

There are various reasons why calculating PV is important:

- Compare investments: Present value allows you to compare investments with different time horizons and cash flow patterns. This helps you choose the option that offers the best return for your money today.

- Investment decision-making: Businesses use PV to evaluate potential projects and investments, considering their future profitability and comparing them to other investment opportunities.

- Valuation: PV is used in valuing assets like capitalized leases, bonds, annuities, and companies, by discounting their future cash flows to determine their current worth.

Examples of PV calculation:

- The Lease Accounting Regulations. Under ASC 842 and GASB 96, companies are required to capitalize operating leases on their balance sheet. To do this, a PV calculation is needed to determine the total lease obligation. This involves discounting the future lease payments back to their present value using their cost of funds. This PV amount is then capitalized as an asset and amortized over the lease term.

- Note Industry. PV calculations are used to determine the fair value of debt instruments. This involves discounting the future payments back to their present value using the expected yield on the transaction. This PV then represents the price that a buyer would be willing to pay for the note.

- Settlements. When settling a legal case, a PV calculation can be used to determine the lump-sum payment that would be equivalent to receiving the future payments in the settlement agreement. This calculation discounts the future payments back to their present value using a risk-free rate of return.

- Privately Held Notes. The Applicable Federal Rates (AFRs) are used to impute interest on loans between related parties. To determine the loan amount, a PV calculation is performed using the AFRs as the discount rate. This present value represents the amount of cash that the lender would have received if the loan had been properly documented with the appropriate interest rate.

- Banks and Credit Unions for Troubled Debt Restructuring. When a bank or credit union modifies a troubled loan, they need to perform a PV calculation to determine the Allowance for Loan Loss (ALL). This calculation discounts the future payments under the modified loan agreement back to their present value using the original contractual interest rate. This allows the bank to estimate the potential loss on the loan and adjust their ALL accordingly.

- Evaluate an annuity. An annuity is a series of equal payments that are made at regular intervals. To evaluate an annuity as an investment, a PV calculation is needed to determine the current worth of all future payments. This calculation discounts the future payments back to their present value using the appropriate discount rate. This allows investors to compare different annuities and make informed decisions about their investments.

TValue is an excellent program to make challenging PV calculations easy. The key is to value the first cash flow in the problem. In loan or lease situations, the PV / NPV would normally be the first Loan Event. In investment analysis situations, the PV / NPV would normally be the first Deposit Event. To solve for the present value, you would usually put “U” for unknown on line 1 for the Amount and then add the future cash flows at the appropriate discount rate.

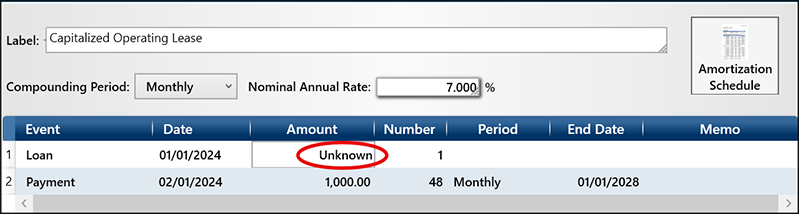

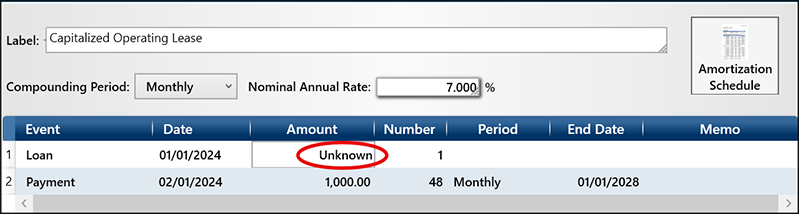

Following is an example of an operating lease with payments of $1,000 per month for 48 months that needs to be capitalized. Let’s assume our company’s borrowing rate is 7%. Below, we solved for the Loan Amount. In this case, that amount would be $41,760.19.

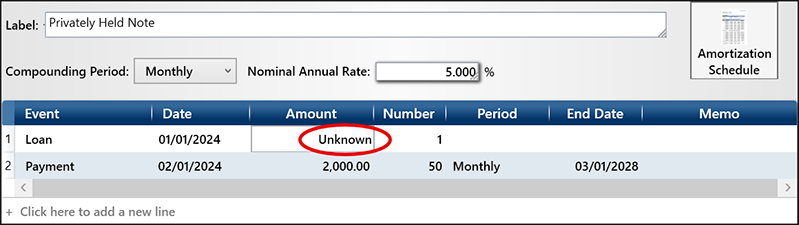

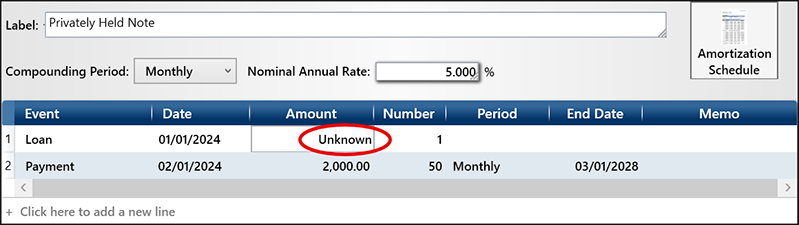

Another example would be a privately held note to a family member. Let’s say the note is for $100,000 with payments of $2,000 a month for 50 months. With this structure, there is no interest but the IRS says you have to charge interest and you have to use the minimum of the current AFR rate at the time of the loan. Let’s use an AFR rate of 5%. The present value would be $90,101.84 and the imputed interest over the life of the loan would be $9,898.16.

By understanding and applying PV calculations, you can make informed financial decisions and ensure you receive the best value for your money.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.