Per diem interest is the interest charged on a loan on a daily basis. The finance charge is interest calculated since the last time a payment was made. Often, you have a loan payoff at a point in time and it doesn’t close and you need to determine the per diem interest for each day the loan doesn’t get paid off.

You can calculate the per diem interest by multiplying the loan balance by the interest rate and then dividing it by 365. It is generally easier and more accurate to use an amortization program such as TValue software.

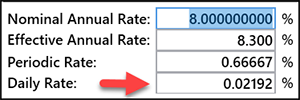

In TValue, there are two easy ways to get the per diem interest amount. The first is to use the daily interest rate. On the Cash Flow data screen, you can click on the bottom right corner of the Nominal Annual Rate field and it will display four interest rates including the Daily Rate. If you take the loan balance times the Daily Rate, you will get the per diem rate for that balance.

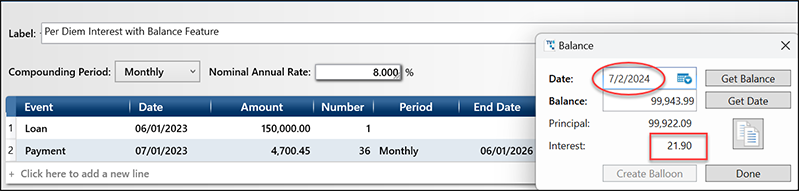

If you want TValue to calculate the per diem amount for you, you can use the Balance feature. The Balance feature will allow you to enter a date and TValue will calculate the last principal balance and the interim interest. If you enter the date one day after the normal payments, TValue will effectively give you one days’ interest or your per diem interest for that balance.

In the example above, we clicked Balance and then put the date on the second with the regular payments on the first, and TValue calculated one days’ interest.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.