The Estimated Tax Penalty is actually an interest calculation. The underpayment penalty is the difference between your required annual payment and what you've already paid through withholding, credits, and any estimated tax payments. Once you determine the net amount owed, calculating the penalty becomes straightforward, particularly with TaxInterest software.

To determine the annual payment, you'll consider the smaller of two options:

- 90% of the tax shown on your current year’s tax return

OR

- 100% of the tax shown on your previous year’s tax return (110% if your previous year’s adjusted gross income was more than $150,000 or $75,000 if married filing separately).

While exceptions exist, these guidelines provide a general basis.

The calculation process divides the annual amount into four installments based on the tax deposit due dates. These net amounts serve as the basis for calculating interest.

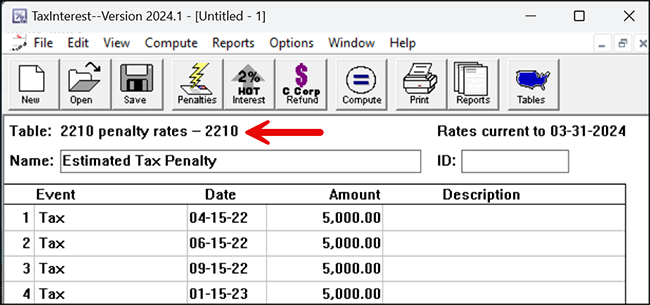

In TaxInterest, select either the 2210.TB3 Table for individuals or the 2220.TB3 for corporations. These tables utilize the same rates as the Federal rate, but they compute interest using simple interest rather than daily compounding.

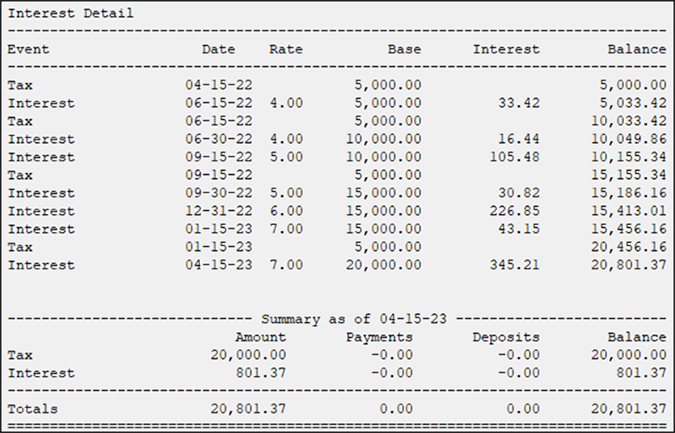

After accessing the rate table, input the necessary data for the calculation. For example, if you have a $20,000 underpayment, input four Tax Events corresponding to the deposit due dates, with each valued at $5,000.

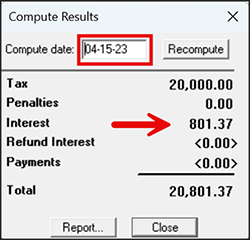

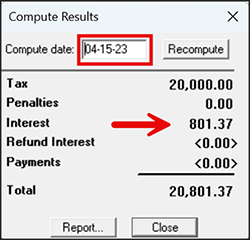

Next, adjust the Compute date to match the tax due date for the year. The resulting interest calculation, such as $801.37, constitutes the Estimated Tax Penalty.

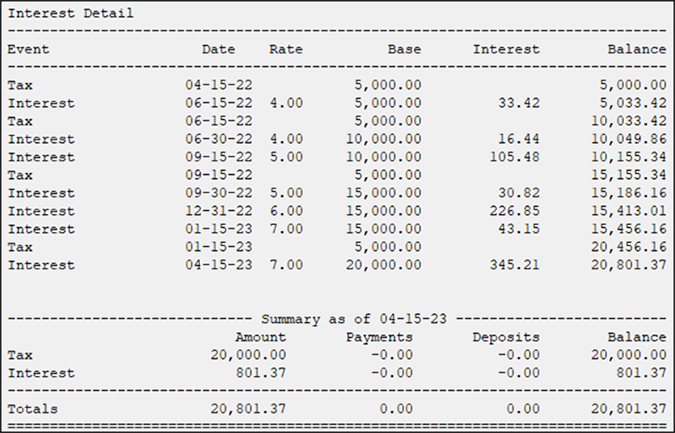

As shown in the TaxInterest Report, interest accrues from the first missed deposit (Tax), with subsequent missed deposits incrementally increasing the balance until the tax due date.

Understanding both the concept and mechanics of the Estimated Tax Penalty is important. Once you determine the interest amount, the Estimated Tax Penalty is considered interest-bearing from the assessment date and is included to your standard underpayment calculation as an Entered Penalty.

If you have any questions using TaxInterest software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.