The Failure to File (FTF) (6651(a)(1)) penalty has some interesting aspects to understand when calculating or reconciling. It may seem straightforward but understanding the nuances reveals a complex web of rules and exceptions.

One of the nuances is that the penalty can be less than 5% if there is also a Failure to Pay (FTP) (6651(a)(2)) penalty. Another is that the penalty does not cease if you pay it, it only stops accruing when you file. Additionally, interest is calculated on the entire balance from day one.

Understanding the Penalty Structure

The FTF penalty is assessed at a rate of 5% per month or a fraction of a month until the return is filed to a maximum of 25% or five months. However, like many IRS procedures, there are exceptions. When the FTF and FTP penalties run simultaneously, the taxpayer is only responsible for 5%, so the FTF penalty is reduced to 4.5% and caps at 22.5%.

Payment Doesn’t Halt Accrual

Another unique aspect of the FTF penalty is that making a tax payment does not halt the accrual of the FTF penalty. Even if you promptly pay your taxes after missing the filing deadline, the penalty continues to accrue until the return is filed. The penalty is calculated based on the amount of tax due on the tax due date, and the 5% per month penalty accrues even if the tax is paid.

True story: We had a call from a CPA who had advised his client to pay his roughly $40,000 tax on April 20th, just a few days late. Since the tax was paid, he didn’t file an extension and didn’t file the return until the extension due date on October 15th. His FTP penalty was 0.5% for one month or $200. However, his FTF penalty was about $9,800 or 24.5% because the FTF penalty goes back to the amount of tax on the due date of the return and counts the month till the return is filed. There was a lesson learned here.

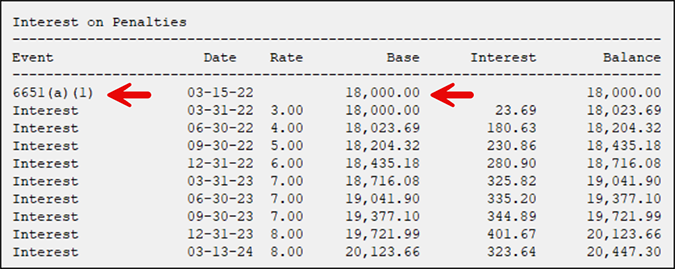

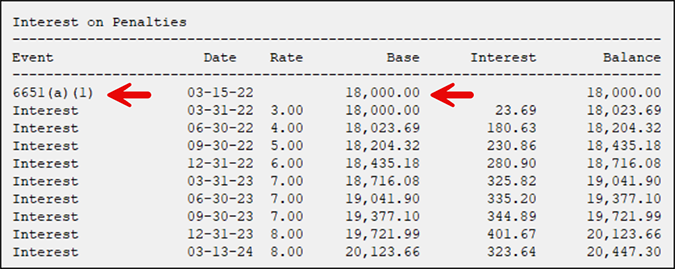

Interest on the Entire Balance

Another peculiarity of the FTF penalty is how the interest is calculated. While the penalty may take up to five months to reach its maximum, interest accrues on the entire tax balance from the due date (or the extension date, if applicable). This deviates from the classic understanding of time value of money calculations. Below is an example of a FTF penalty of $18,000 on 3-15-22 and how interest is being charged on the entire balance from the due date.

TaxInterest Software: Your Guide Through the Maze

Navigating the complexities of tax penalties and interest requires precision and accuracy. Tools like TaxInterest software are designed to handle these calculations effortlessly. With built-in IRS regulations and comprehensive calculation capabilities, it ensures compliance and minimizes errors.

If you need any help with interest and penalty calculations using TaxInterest, please give our TimeValue Software Support Team a call at 800-426-4741 or email us at support@TimeValue.com.