Managing seasonal cash flows of a business can be an art and a science. For a lender, the key to success is making life easier for the borrower or lessee. One opportunity for Lenders/lessors is to structure loans or leases with monthly skipped or modified payments when appropriate and creating a win-win for both parties. This structuring can separate you from the competition.

Factoring in monthly skipped or modified payments throughout a term, especially when your customer has seasonal cash flows, can be a great way to structure and close a deal. Being able to manage the cash flows of the seasonal cash flow can be a win for both parties.

Monthly skip payments on a loan or lease offer a number of advantages, including:

- Improved cash flow: Skipped/modified payments can help your customer manage their cash flow more effectively by allowing them to modify certain payments during their seasonal slow periods.

- Flexibility: Skipped/modified payments can also give your customer more flexibility in their budgeting and planning.

In addition to these general advantages, skipped/modified payments can also offer specific benefits depending on the type of loan or lease you have.

Here are some specific examples of how skipped/modified payments can be used:

- A business owner can use skipped/modified payments to defer loan or lease payments during their off-season when revenue is lower.

- A farmer can use skip payments to defer or minimize loan or lease payments during the winter months when they are not operating.

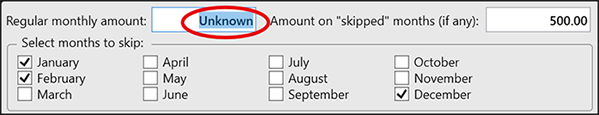

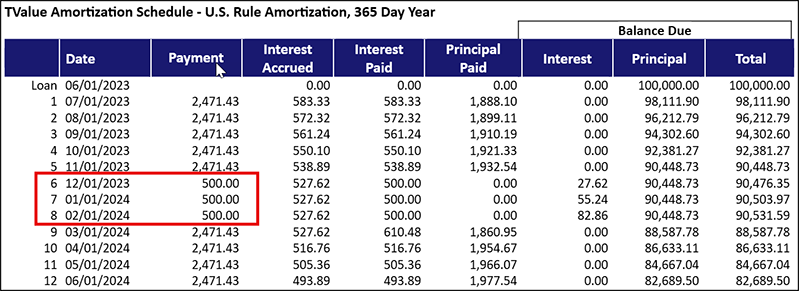

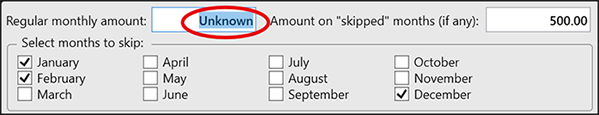

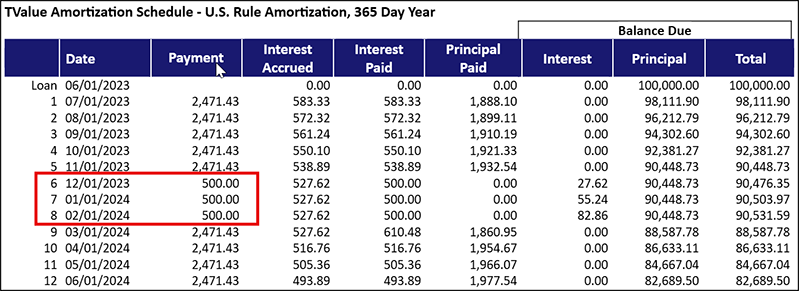

TValue amortization software is an excellent program to structure skipped/modified payments with its “Monthly Skip” series. This series allows you to determine the skipped/modified payments on the precise months. In our example, we have payments of $500.00 in December, January, and February and ask TValue to solve for the remaining months.

In the amortization schedule, we have regular payments in the non-seasonal months and skipped/modified payments in the seasonal months.

Overall, monthly skipped/modified payments on a loan or lease can offer a number of advantages, including improved cash flow, flexibility, and reduced financial stress. However, it is important to carefully consider the terms of your loan or lease agreement before agreeing to skip a payment and verifying that your lender is supportive of this deal structure.

If you have any questions using TValue software, please give our Support Team a call at 800-426-4741 or email us at support@TimeValue.com.