The concept of a minimum lease payment is an important variable used in the recovery of investment test (90% test), which is used to determine if an agreement should be treated as an operating or capital lease.

The minimum lease payments are the lowest amount that a lessee can expect to make over the lifetime of the lease. The minimum lease payments, including a guarantee of a residual if applicable, are used to value the lease by doing a present value (PV) calculation. The method of calculating minimum lease payments is laid out in the Statement of Financial Accounting Standards No. 13 (FAS 13), Accounting for Leases.

Minimum lease payments are the rental payments over the lease term including the amount of any bargain purchase option, premium, and any guaranteed residual value, and excluding any rental relating costs such as maintenance or insurance to be met by the lessor and any contingent rentals.

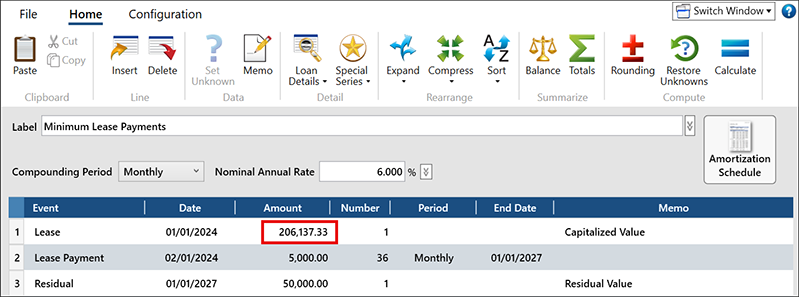

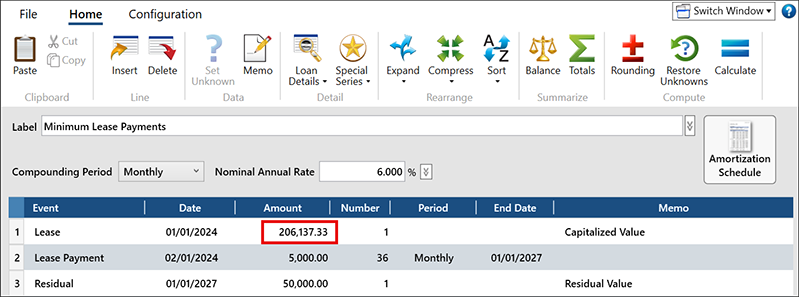

The value of a lease is determined by discounting the minimum lease payments at a given interest rate. As an example, let’s assume we have a machine with a 3-year lease with minimum payments of $5,000 per month with a guaranteed residual of $50,000. Lessors may use the interest rate implicit in the lease or the lessee’s incremental borrowing rate as the discount rate to do the NPV calculation. We’ll assume a discount rate of 6% per year.

To calculate the NPV of the equipment in TValue software, we will enter 6% for the Nominal Annual Rate. On Line 1, we’ll use Lease as the Event and put the appropriate inception date for the Lease and then “U” for unknown. Then we will input our minimum lease payment of $5,000 for 36 months. You need to be sensitive to the dates as the initial payment may be in advance or in arrears. We will use arrears.

On Line 3, use Residual for the Event and make sure the date is three years from the Lease date. You may have to adjust it for one month. Then click Compute and you will get a present value of $206,137.33 on Line 1. Once you have laid out the key factors, the calculation in TValue is pretty simple.

Accounting for minimum lease payments differs from the perspectives of the lessee and lessor. To learn more about this subject, read the original document available from the FASB: Summary of Statement 13.

If you have any questions or need any help using TValue software, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.