Both the Internal Rate of Return (IRR) and the Rate of Return Index (RRI) or Compound Annual Growth Rate (CAGR)) are key measurements for the performance of investments but they are somewhat different.

The IRR function calculates the internal rate of return for a series of cash flows and measures investment performance. The RRI/CAGR measures the return on an investment over a certain period of time.

IRR focuses on the discount rate that breaks even, while RRI/CAGR focuses on the average annualized growth rate. Both of these calculations are easy to do in TValue.

IRR is the discount rate that makes the net present value (NPV) of all cash flows associated with an investment equal to zero. This means the annualized growth rate that your investment would need to achieve to break even after factoring in the Nominal Annual Rate.

RRI can have different meanings depending on context. In some cases, it might refer to the Rate of Return Index, which is essentially another term for Compound Annual Growth Rate. CAGR represents the average annualized growth rate of an investment over a specific period, taking into account compounding interest.

RRI/CAGR is specifically designed for annualized returns and is often preferred for comparing investments over different time horizons.

Let’s do a couple of case studies to see how the calculations can be done in TValue software. In both examples, with annual compounding, you would input your cash flows and then solve for the Nominal Annual Rate by entering the letter “U” for Unknown.

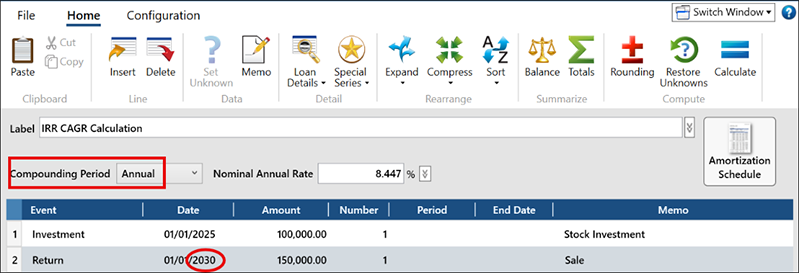

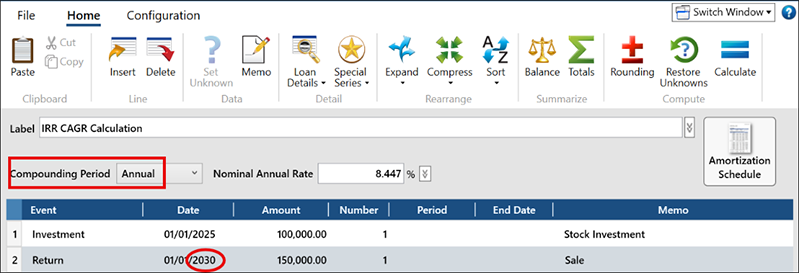

RRI/CAGR Example: Stock Investment

Let's consider a simple stock investment and calculate the CAGR. The calculation is effectively from point A to point B with annual compounding.

Assumptions:

- You purchased stock for $100,000.

- You sold the stock in 5 years for $150,000.

With annual compounding, you would have a Nominal Annual Rate of 8.447%.

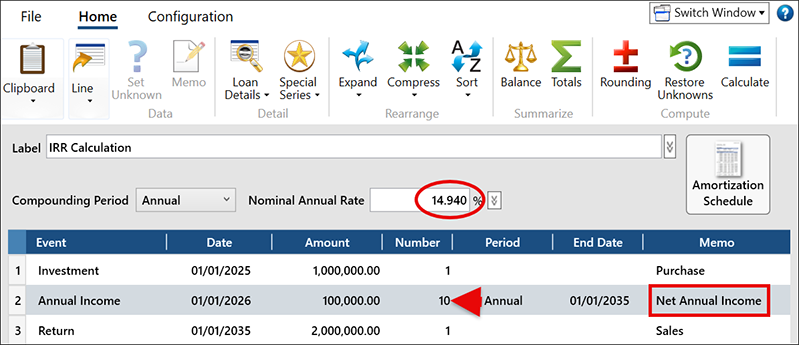

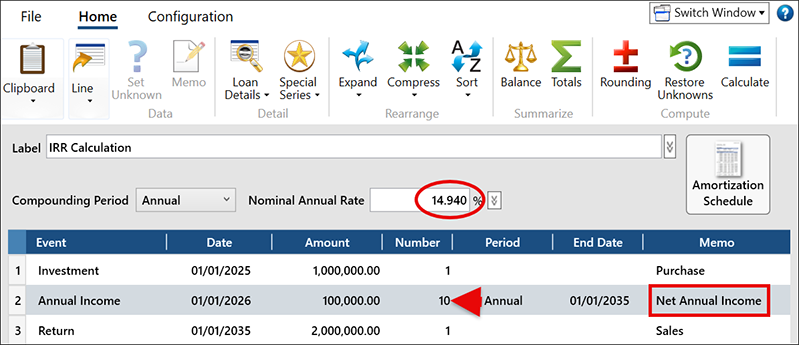

IRR Example: Real Estate Investment

Let's do a real estate investment, with both annual income and a value at the end of 10 years.

Assumptions:

- You purchase a property for $1,000,000.

- Annual rental income is projected to be $125,000 and your operating expenses are $25,000 so your net income is $100,000 per year.

- You plan on selling the property in 10 years for $2,000,000.

In this example, you have annual cash flows and a sales/return in 10 years. With these assumptions, you would have a Nominal Annual Rate of 14.94%. If you had a 15% hurdle rate to make this investment, you are almost there.

If you have any questions using TValue software or are interested in TValue, please give our Support Team a call at 800-426-4741 or shoot us an email at support@TimeValue.com.