Your Tool for Calculating the Greatest Netting Benefit

IRS net rate netting can save and recover substantial amounts of interest for your client. However, the identification of overlapping interest periods and the application of rate equalization can be an extensive process. TaxInterest Netting is the new solution to handle these calculations comprehensively and accurately.

WHAT IS INTEREST NETTING?

- Beginning in 1986, Congress increased the interest rate applicable to corporate tax underpayments compared to the rate payable to the same corporate taxpayer for interest on tax overpayments

- This rate differential meant that a corporation could owe interest even when it had no net tax liability because of overpayments and underpayments that existed during the same time

- In 1998, congress stepped in and enacted IRC Sec. 6621(d) to solve the net interest problem the new rates had created. This new act benefits the corporate taxpayer by allowing the elimination of the interest rate differential on underpayment and overpayment of federal taxes

- This Net Rate Netting can apply to taxes such as income, employment, excise, etc.

- TaxInterest Netting software gives you the tool to handle overlapping interest rates and perform net rate netting

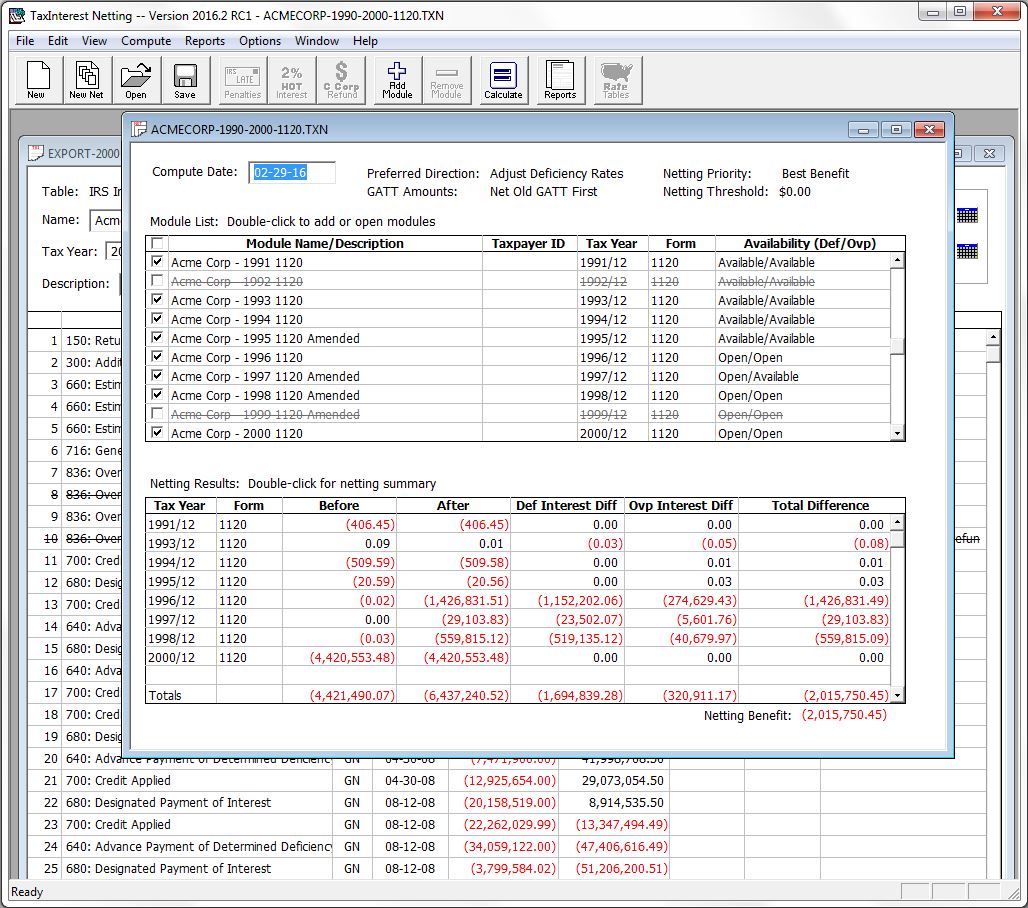

COMPLETE OFFSETTING AND EQUALIZATION

- Handle overlapping interest rates per IRS code and procedures

- Accurate calculations of global interest netting benefit per Section 6621(d)

- Identify overlapping periods, amounts and rates

- Compute interest rate equalization

- Identify remaining available balances for potential future netting

- Compute underpayment or overpayment interest on any remaining amounts

- Determine interest accruals on 6603 deposits

- Identify possible offsetting benefits

INTUITIVE ENTRY OF TRANSCRIPT DETAIL

- User-friendly interface accepts and organizes IRS transcript data and state tax information

- Transaction code events allow for interest suspension periods and restricted interest computations

- Flexible interface gives you unmatched capability for “what-if” netting scenarios to determine the best benefit

- GATT interest and large corporate (Hot) interest

- Netting benefit totals and detail are a click-away

- Create custom rate tables as needed for sales tax, estate tax, lookback, excise, and more

- Interest rates and methods for all calculations are built in and automatically updated each quarter

REPORTS PROVIDE UNRIVALED DETAIL FOR INDIVIDUAL AND NETTING CALCULATIONS

- Netting reports are widely recognized by the IRS

- Interest Summary - parallels the content of IRS 490 report

- Interest Detail - shows netting detail unavailable elsewhere

- Used Positions - for current netting calculation

- Available Positions - shows future netting possibilities

- Netted Positions

- Adjustment Summary - Detail is available in expanded format within Excel and more

The Choice Of Tax Professionals For Reliable, Flexible, And Cutting Edge Netting Calculations

Pricing

Call or email for pricing specific to your needs

All TimeValue Software products come with a one year money-back guarantee, so your purchase is risk free.

Frequently asked questions

I am currently using a different application for interest netting. Will I be able to import my file information into TaxInterest Netting software?

Yes. TaxInterest Netting software will import information from a csv file format which other programs will create via export.

How do I perform what-if interest netting calculations?

TaxInterest Netting allows you to enter transcript data for individual tax years independently and then select the appropriate modules to include in a netting calculation. You can then exclude modules to see instant effect on the netting calculation.

How are the interest rates kept current with Interest Netting?

Your annual subscription for TaxInterest Netting includes quarterly interest rate updates and all program updates during your subscription. Interest rate updates are downloaded automatically each day when you open your program from TimeValue Software servers so your rates are always current.